What Factors Determine The Cost Of Producing A Good Or Service? Check All That Apply.

Marketplace Differences Between Monopoly and Perfect Competition

Monopolies, equally opposed to perfectly competitive markets, accept high barriers to entry and a unmarried producer that acts as a price maker.

Learning Objectives

Distinguish between monopolies and competitive firms

Fundamental Takeaways

Fundamental Points

- In a perfectly competitive market, there are many producers and consumers, no barriers to exit and entry into the market, perfectly homogenous goods, perfect data, and well-divers property rights.

- Perfectly competitive producers are cost takers that can choose how much to produce, simply not the cost at which they tin can sell their output.

- A monopoly exists when at that place is only one producer and many consumers.

- Monopolies are characterized by a lack of economical competition to produce the good or service and a lack of viable substitute appurtenances.

Key Terms

- perfect competition: A blazon of market with many consumers and producers, all of whom are price takers

- network externality: The effect that 1 user of a practiced or service has on the value of that product to other people

- perfect data: The assumption that all consumers know all things, nigh all products, at all times, and therefore always brand the best decision regarding purchase.

A marketplace can be structured differently depending on the characteristics of competition within that market. At one farthermost is perfect competition. In a perfectly competitive market, in that location are many producers and consumers, no barriers to enter and exit the market, perfectly homogeneous goods, perfect information, and well-defined property rights. This produces a organization in which no individual economic role player tin can touch on the toll of a good – in other words, producers are price takers that can choose how much to produce, but not the price at which they can sell their output. In reality there are few industries that are truly perfectly competitive, but some come very close. For example, article markets (such every bit coal or copper) typically have many buyers and multiple sellers. In that location are few differences in quality betwixt providers so goods can exist easily substituted, and the goods are simple enough that both buyers and sellers take full information most the transaction. Information technology is unlikely that a copper producer could raise their prices above the market rate and yet detect a buyer for their product, and then sellers are price takers.

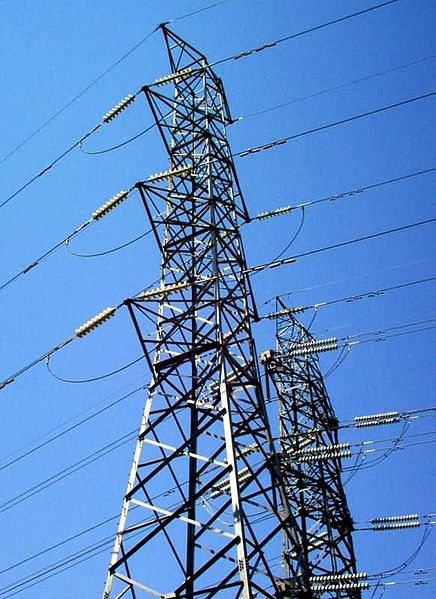

A monopoly, on the other mitt, exists when there is simply one producer and many consumers. Monopolies are characterized by a lack of economic competition to produce the good or service and a lack of viable substitute goods. As a consequence, the single producer has control over the cost of a practiced – in other words, the producer is a price maker that can decide the cost level by deciding what quantity of a good to produce. Public utility companies tend to be monopolies. In the example of electricity distribution, for instance, the toll to put upward ability lines is so high it is inefficient to have more one provider. In that location are no good substitutes for electricity delivery so consumers accept few options. If the electricity benefactor decided to heighten their prices it is probable that most consumers would continue to purchase electricity, and so the seller is a toll maker.

Electricity Distribution: The price of electric infrastructure is and so expensive that there are few or no competitors for electricity distribution. This creates a monopoly.

Sources of Monopoly Power

Monopoly ability comes from markets that take high barriers to entry. This can exist acquired past a variety of factors:

- Increasing returns to scale over a large range of production

- High majuscule requirements or large inquiry and development costs

- Product requires control over natural resource

- Legal or regulatory barriers to entry

- The presence of a network externality – that is, the use of a product past a person increases the value of that product for other people

Monopoly Vs. Perfect Competition

Monopoly and perfect contest mark the two extremes of marketplace structures, but at that place are some similarities between firms in a perfectly competitive marketplace and monopoly firms. Both face up the same cost and production functions, and both seek to maximize profit. The shutdown decisions are the same, and both are assumed to take perfectly competitive factors markets.

However, there are several central distinctions. In a perfectly competitive marketplace, price equals marginal toll and firms earn an economical profit of zero. In a monopoly, the cost is fix above marginal cost and the firm earns a positive economic turn a profit. Perfect competition produces an equilibrium in which the price and quantity of a good is economically efficient. Monopolies produce an equilibrium at which the price of a good is college, and the quantity lower, than is economically efficient. For this reason, governments oft seek to regulate monopolies and encourage increased competition.

Marginal Revenue and Marginal Cost Relationship for Monopoly Production

For monopolies, marginal cost curves are upwardly sloping and marginal revenues are downwards sloping.

Learning Objectives

Analyze how marginal and marginal costs bear on a company's production decision

Key Takeaways

Fundamental Points

- Firm typically have marginal costs that are low at low levels of product but that increase at college levels of production.

- While competitive firms experience marginal revenue that is equal to toll – represented graphically by a horizontal line – monopolies have downwardly-sloping marginal revenue curves that are different than the proficient's cost.

- For monopolies, marginal revenue is always less than price.

Key Terms

- marginal acquirement: The additional profit that will be generated by increasing production sales by one unit of measurement.

- marginal toll: The increase in cost that accompanies a unit of measurement increase in output; the partial derivative of the cost function with respect to output. Additional cost associated with producing ane more unit of output.

Profit Maximization

In traditional economic science, the goal of a firm is to maximize their profits. This means they want to maximize the difference between their earnings, i.due east. acquirement, and their spending, i.east. costs. To find the profit maximizing betoken, firms await at marginal revenue (MR) – the total additional revenue from selling one additional unit of measurement of output – and the marginal toll (MC) – the total additional cost of producing i boosted unit of output. When the marginal acquirement of selling a skillful is greater than the marginal cost of producing it, firms are making a profit on that product. This leads direct into the marginal decision rule, which dictates that a given skilful should continue to be produced if the marginal revenue of ane unit is greater than its marginal price. Therefore, the maximizing solution involves setting marginal revenue equal to marginal price.

This is relatively straightforward for firms in perfectly competitive markets, in which marginal acquirement is the same as cost. Monopoly product, even so, is complicated by the fact that monopolies accept demand curves and MR curves that are distinct, causing price to differ from marginal acquirement.

Monopoly: In a monopoly market, the marginal acquirement curve and the demand bend are distinct and down-sloping. Production occurs where marginal cost and marginal revenue intersect.

Perfect Contest: In a perfectly competitive market place, the marginal revenue curve is horizontal and equal to need, or price. Product occurs where marginal cost and marginal acquirement intersect.

Monopoly Profit Maximization

The marginal price curves faced past monopolies are similar to those faced by perfectly competitive firms. Most will accept low marginal costs at low levels of production, reflecting the fact that firms can accept advantage of efficiency opportunities as they brainstorm to grow. Marginal costs get higher equally output increases. For instance, a pizza restaurant can easily double production from one pizza per hour to two without hiring boosted employees or ownership more sophisticated equipment. When production reaches 50 pizzas per hour, even so, it may be difficult to grow without investing a lot of money in more skilled employees or more than high-tech ovens. This tendency is reflected in the up-sloping portion of the marginal cost curve.

The marginal revenue curve for monopolies, yet, is quite different than the marginal revenue curve for competitive firms. While competitive firms experience marginal revenue that is equal to price – represented graphically by a horizontal line – monopolies have downward-sloping marginal revenue curves that are different than the skilful's toll.

Profit Maximization Role for Monopolies

Monopolies fix marginal cost equal to marginal revenue in order to maximize profit.

Learning Objectives

Explain the monopolist'southward profit maximization function

Key Takeaways

Key Points

- The get-go-order status for maximizing profits in a monopoly is 0=∂q=p(q)+qp′(q)−c′(q), where q = the profit-maximizing quantity.

- A monopoly's profits are represented by π=p(q)q−c(q), where acquirement = pq and cost = c.

- Monopolies have the ability to limit output, thus charging a higher price than would be possible in competitive markets.

Key Terms

- first-order condition: A mathematical relationship that is necessary for a quantity to be maximized or minimized.

- deadweight loss: A loss of economic efficiency that tin occur when an equilibrium is not Pareto optimal.

Monopolies take much more ability than firms commonly would in competitive markets, but they still face limits adamant by demand for a production. Higher prices (except under the most extreme conditions) hateful lower sales. Therefore, monopolies must brand a conclusion about where to set their price and the quantity of their supply to maximize profits. They tin can either choose their toll, or they can choose the quantity that they will produce and allow market demand to set the toll.

Since costs are a role of quantity, the formula for profit maximization is written in terms of quantity rather than in toll. The monopoly'south profits are given by the following equation:

π=p(q)q−c(q)

In this formula, p(q) is the price level at quantity q. The cost to the business firm at quantity q is equal to c(q). Profits are represented by π. Since revenue is represented past pq and cost is c, profit is the difference between these two numbers. Every bit a result, the first-society condition for maximizing profits at quantity q is represented past:

0=∂q=p(q)+qp′(q)−c′(q)

The above first-order condition must ever be truthful if the firm is maximizing its turn a profit – that is, if p(q)+qp′(q)−c′(q) is not equal to zero, and then the business firm can change its price or quantity and brand more than profit.

Marginal acquirement is calculated by p(q)+qp′(q), which is derived from the term for revenue, pq. The term c′(q) is marginal cost, which is the derivative of c(q). Monopolies will produce at quantity q where marginal acquirement equals marginal cost. So they volition charge the maximum price p(q) that market demand will respond to at that quantity.

Consider the example of a monopoly firm that can produce widgets at a cost given past the following function:

c(q)=two+3q+q2

If the firm produces ii widgets, for case, the full price is 2+three(2)+22=12. The price of widgets is determined by demand:

p(q)=24-2p

When the firm produces 2 widgets it can accuse a price of 24-2(ii)=xx for each widget. The firm's profit, as shown in a higher place, is equal to the difference between the quantity produces multiplied by the price, and the total cost of product: p(q)q−c(q). How tin can we maximize this role?

Using the kickoff order status, nosotros know that when turn a profit is maximized, 0=p(q)+qp′(q)−c′(q). In this case:

0=(24-2p)+q(-2)-(3+2q)=21-6q

Rearranging the equation shows that q=3.5. This is the profit maximizing quantity of production.

Consider the diagram illustrating monopoly competition. The key points of this diagram are fivefold.

- Beginning, marginal acquirement lies beneath the demand curve. This occurs because marginal revenue is the demand, p(q), plus a negative number.

- Second, the monopoly quantity equates marginal revenue and marginal cost, but the monopoly price is higher than the marginal toll.

- Third, there is a deadweight loss, for the same reason that taxes create a deadweight loss: The college price of the monopoly prevents some units from being traded that are valued more than highly than they toll.

- Fourth, the monopoly profits from the increment in cost, and the monopoly turn a profit is illustrated.

- 5th, since—under competitive atmospheric condition—supply equals marginal cost, the intersection of marginal cost and demand corresponds to the competitive outcome.

We meet that the monopoly restricts output and charges a higher price than would prevail under competition.

Monopoly Diagram: This graph illustrates the toll and quantity of the marketplace equilibrium nether a monopoly.

Monopoly Production Decision

To maximize output, monopolies produce the quantity at which marginal supply is equal to marginal cost.

Learning Objectives

Explain how to identify the monopolist'south production bespeak

Key Takeaways

Central Points

- Unlike a competitive company, a monopoly can decrease production in order to charge a higher price.

- Because of this, rather than finding the point where the marginal cost curve intersects a horizontal marginal revenue curve (which is equivalent to good's price), nosotros must find the point where the marginal toll curve intersect a downwards-sloping marginal revenue curve.

- Monopolies take downward sloping demand curves and downward sloping marginal revenue curves that have the same y-intercept equally demand just which are twice equally steep.

- The shape of the curves shows that marginal revenue will always exist below demand.

Key Terms

- marginal cost: The increment in price that accompanies a unit increase in output; the partial derivative of the cost function with respect to output. Additional cost associated with producing i more unit of measurement of output.

- marginal revenue: The additional profit that will exist generated by increasing production sales by one unit.

Monopoly Production

A pure monopoly has the same economic goal of perfectly competitive companies – to maximize profit. If we assume increasing marginal costs and exogenous input prices, the optimal decision for all firms is to equate the marginal cost and marginal revenue of production. Notwithstanding, a pure monopoly can – unlike a firm in a competitive market – alter the market place price for its own convenience: a decrease of production results in a higher price. Because of this, rather than finding the betoken where the marginal cost bend intersects a horizontal marginal revenue bend (which is equivalent to practiced'southward price), nosotros must find the point where the marginal toll curve intersect a downward-sloping marginal revenue curve.

Monopoly Production Point

Like non-monopolies, monopolists will produce the at the quantity such that marginal revenue (MR) equals marginal toll (MC). Nevertheless, monopolists have the ability to change the market place price based on the amount they produce since they are the only source of products in the market. When a monopolist produces the quantity determined by the intersection of MR and MC, information technology can charge the cost determined by the market demand curve at the quantity. Therefore, monopolists produce less only accuse more than a firm in a competitive market.

Monopoly Production: Monopolies produce at the signal where marginal revenue equals marginal costs, but charge the price expressed on the market need bend for that quantity of production.

In brusk, 3 steps can make up one's mind a monopoly firm's profit-maximizing price and output:

- Calculate and graph the firm's marginal acquirement, marginal cost, and demand curves

- Identify the signal at which the marginal acquirement and marginal price curves intersect and determine the level of output at that point

- Employ the demand curve to detect the price that tin can be charged at that level of output

Monopoly Price and Profit

Monopolies can influence a good's price by irresolute output levels, which allows them to make an economic profit.

Learning Objectives

Analyze the terminal price and resulting profit for a monopolist

Key Takeaways

Key Points

- Typically a monopoly selects a higher price and lesser quantity of output than a price-taking company.

- A monopoly, dissimilar a perfectly competitive firm, has the market all to itself and faces the downwards-sloping market demand bend.

- Graphically, one can find a monopoly's cost, output, and profit past examining the need, marginal cost, and marginal revenue curves.

Key Terms

- economical profit: The divergence between the total revenue received by the house from its sales and the total opportunity costs of all the resources used by the business firm.

- demand: The desire to purchase goods and services.

Monopolies, dissimilar perfectly competitive firms, are able to influence the price of a skillful and are able to make a positive economical profit. While a perfectly competitive firm faces a single marketplace price, represented by a horizontal demand/marginal acquirement curve, a monopoly has the market all to itself and faces the downward-sloping market demand curve. An important consequence is worth noticing: typically a monopoly selects a higher price and bottom quantity of output than a cost-taking visitor; again, less is bachelor at a higher toll.

Imagine that the market demand for widgets is Q=thirty-2P. This says that when the cost is one, the market volition demand 28 widgets; when the price is two, the market place volition need 26 widgets; and and so on. The monopoly's total revenue is equal to the toll of the widget multiplied by the quantity sold: P(30-2P). This can also be rearranged and so that it is written in terms of quantity: full revenue equals Q(30-Q)/ii.

The house tin produce widgets at a total toll of 2Q2, that is, it can produce one widget for $2, two widgets for $8, 3 widgets for $xviii, and so on. We know that all firms maximize profit by setting marginal costs equal to marginal revenue. Finding this point requires taking the derivative of total acquirement and full cost in terms of quantity and setting the 2 derivatives equal to each other. In this example:

[latex]\frac{dTR}{dQ}=\frac{(30-2Q)}{ii}[/latex]

[latex]\frac{dTC}{dQ} =4Q[/latex]

Setting these equal to each other: [latex]15-Q=4Q[/latex]

So the profit maximizing signal occurs when Q=3.

At this point, the price of widgets is $13.fifty, the monopoly's total acquirement is $forty.50, the total price is $xviii, and turn a profit is $22.50. For comparison, it is easy to see that if the house produced two widgets cost would be $14 and profit would be $20; if it produced four widgets price would be $13 and profit would over again be $20. Q=three must be the turn a profit-maximizing output for the monopoly.

Graphically, 1 can discover a monopoly'southward price, output, and turn a profit past examining the need, marginal cost, and marginal revenue curves. Again, the firm will always set output at a level at which marginal cost equals marginal revenue, so the quantity is constitute where these 2 curves intersect. Toll, still, is adamant past the need for the good when that quantity is produced. Because a monopoly'south marginal revenue is always below the need curve, the price will always be above the marginal price at equilibrium, providing the firm with an economic profit.

Monopoly Pricing: Monopolies create prices that are higher, and output that is lower, than perfectly competitive firms. This causes economic inefficiency.

Source: https://courses.lumenlearning.com/boundless-economics/chapter/monopoly-production-and-pricing-decisions-and-profit-outcome/

Posted by: morrislible1943.blogspot.com

0 Response to "What Factors Determine The Cost Of Producing A Good Or Service? Check All That Apply."

Post a Comment